Corporate governance

AKA was founded in 1952 as a centre of competence for German banks. The goal was to develop new ways of financing international export transactions. Today AKA has an outstanding network across Europe and supports its shareholders and stakeholders with 70 years of experience in export and trade finance. It is currently working as an experienced partner by the side of 17 shareholder banks. In addition to the shareholders, the governance bodies play a key role in AKA’s corporate structures: Supervisory Board, Risk Committee and Nomination and Remuneration Control Committee.

Specialists with decades of experience

All advantages for AKA shareholder banks at a glance

AKA sees itself as a supplementary structuring and financing supporter to back up its shareholder banks’ operating infrastructure. It is committed to strengthening its shareholders’ capabilities on a sustained basis. The principle of integrity and collaboration based on a spirit of mutual trust is a crucial determinant for the success of its business model. Consequently, AKA does not compete with its shareholder banks.

In addition to the advantages of working together with AKA described here, shareholders enjoy the following exclusive privileges:

- Working on behalf of its shareholder banks, AKA is enhancing the range of services for Small Ticket buyer credits between EUR 1 million and EUR 10 million. These products are expressly only available to the shareholder banks’ customers.

- Performance of agency functions for ECA-covered buyer credits exclusively for shareholders and syndicates in which the shareholders participate along with access to all updated data relevant for the business relationship via our online B2B portal – free of charge

- Undisclosed sub participations are also assumed in structured finance and syndicated trade loans.

Many of the shareholder banks have been working with AKA very successfully since 1952. The close relations, integrity and cooperation based on a spirit of mutual trust form AKA’s key foundations.

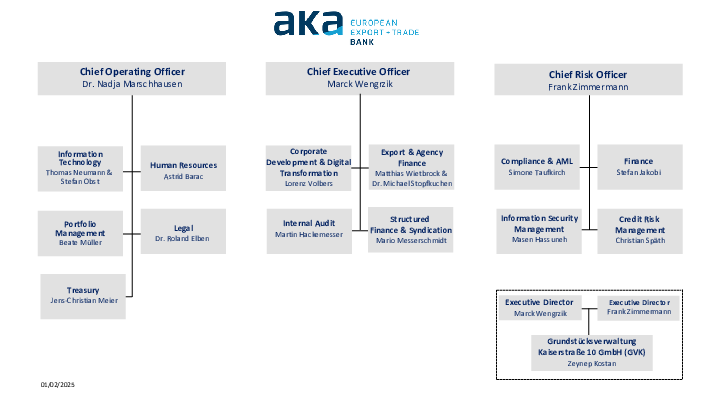

AKA Management

Organisational chart

The Supervisory Board

The Supervisory Board advises and monitors AKA’s management. In accordance with articles of incorporation, it has ten members who representative the shareholders.

Ordinary members

Daniel Schmand

– Chairman –

Reutlingen

Thomas Lingemann

– 1st Deputy Chairman –

Managing Director

Commerzbank AG

Frankfurt/Main

Thomas Dusch

– 2nd Deputy Chairman –

Senior Vice President

UniCredit Bank GmbH

Munich

Jan-Peter Müller

– 3rd Deputy Chairman –

Division Manager Energy and Mobility

Bayerische Landesbank

Munich

Michael Maurer

Managing Director

Landesbank Baden-Württemberg

Stuttgart

Michiel de Vries

Cascais, Portugal

Gottfried Finken

Division Manager Structured Finance

DZ Bank AG Deutsche Zentral Genossenschaftsbank

Frankfurt/Main

Jens Thiele

Managing Director

Hamburg Commercial Bank AG

Hamburg

Thomas Söhlke

Member of the Executive Board

Deutsche Sparkassen Leasing AG & Co. KG

Bad Homburg v. d. H.

Björn Mollner

Head of Structured Trade & Export Finance

Landesbank Hessen-Thüringen Girozentrale

Frankfurt/Main

Permanent representatives

Sandra Primero

Managing Director / Head Risk and Portfolio Management

Deutsche Bank AG

Berlin

Dr. Hanna Lehmann

Head of Transaction Management Specialised Lending

Commerzbank AG

Frankfurt/Main

Inés Lüdke

Managing Director

UniCredit Bank GmbH

Munich

Matthias Öffner

Chapter Lead Trade & Export Finance

Bayerische Landesbank

Munich

Deputy members

Nanette Bubik

Managing Director

Landesbank Baden-Württemberg

Stuttgart

Bartholomeus Ponsioen

Managing Director

ING-DiBa AG

Frankfurt/Main

Ralph Lerch

Director

DZ Bank AG Deutsche Zentral-Genossenschaftsbank

Frankfurt/Main

Jan Lührs-Behnke

Division Manager Finance & Banksteering

Hamburg Commercial Bank AG

Hamburg

Michael Sobl

Global Head of Export Finance

Deutsche Sparkassen Leasing AG & Co. KG,

Bad Homburg v. d. H.

Heinz Boiger

Director Structured Trade & Export Finance

Landesbank Hessen-Thüringen Girozentrale

Frankfurt/Main

Committees

The Supervisory Board is supported by committees to enhance the efficiency of its activities.

Risk Committee

Thomas Lingemann

– Chairman –

Managing Director

Commerzbank AG

Frankfurt/Main

Daniel Schmand

– 1st Deputy Chairman –

Member of the Corporate Bank ExCo

Deutsche Bank AG

Frankfurt/Main

Thomas Dusch

– 2nd Deputy Chairman –

Senior Vice President

UniCredit Bank GmbH

Munich

Jan-Peter Müller

– 3rd Deputy Chairman –

Division Manager Energy and Mobility

Bayerische Landesbank

Munich

Michael Maurer

Managing Director

Landesbank Baden-Württemberg,

Stuttgart

Gottfried Finken

Division Manager Structured Finance

DZ Bank AG Deutsche Zentral Genossenschaftsbank

Frankfurt/Main

Nomination Committee and Remuneration Control Committee

Daniel Schmand

– Chairman –

Member of the Corporate Bank ExCo

Deutsche Bank AG

Frankfurt/Main

Thomas Lingemann

– 1st Deputy Chairman –

Managing Director

Commerzbank AG

Frankfurt/Main

Thomas Dusch

– 2nd Deputy Chairman –

Senior Vice President

UniCredit Bank GmbH

Munich

Jan-Peter Müller

– 3rd Deputy Chairman –

Division Manager Energy and Mobility

Bayerische Landesbank

Munich