A strong market player. Offering solid growth.

We operate as a specialised bank for export finance in over 70 countries worldwide. For our customers, we represent not only a bank for export loans, but also a reliable partner for achieving joint growth.

We posted a solid operating result in 2024, with a pre-tax profit of EUR 32.5 million. Our business model has proven itself once again: resilient, reliable and supported by our core segments of Export & Agency Finance and Structured Finance & Syndication.

In a changing world, we are actively shaping transformation and consistently focussing on the future.

Founded together. Connected to this day.

Our 17 shareholder institutions form the basis of AKA Bank. They comprise both public and private entities. The result is stability, trust and reach. This network puts us in a strong position – and means we are optimally integrated in the financial world. Nationally and beyond.

Consolidated stability. Solid growth.

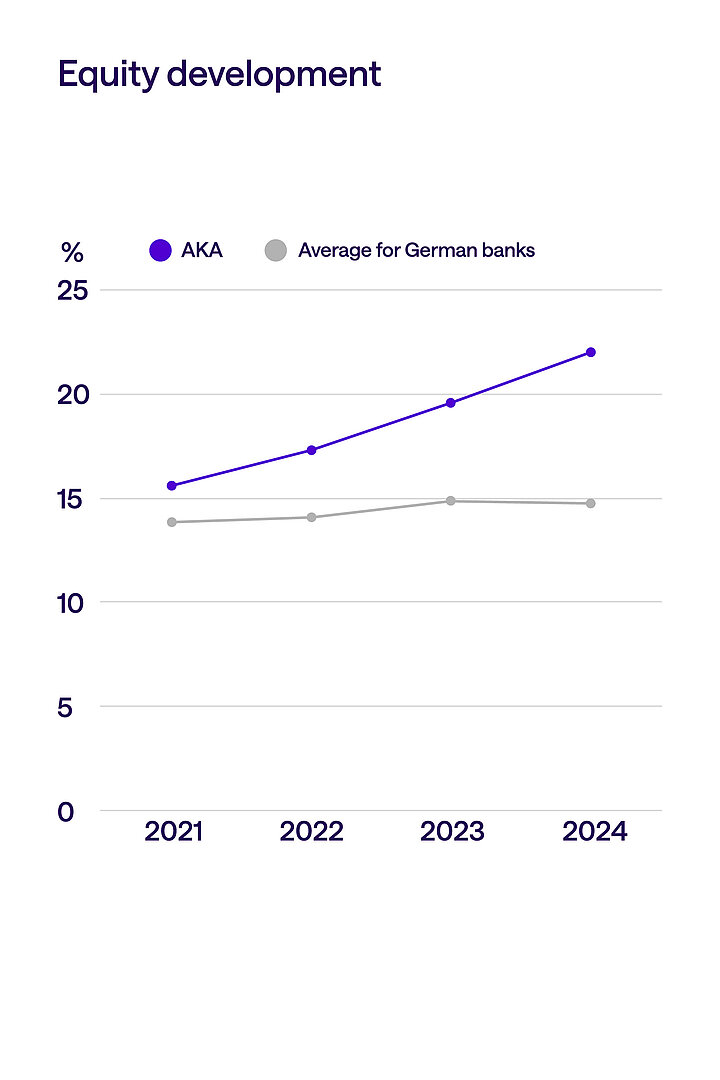

We are continuing to grow and we stand for stability and trust. We create value for our business partners and investors. Our success is based on a balanced refinancing mix, powerful shareholders and our international network. These help us secure liquidity, create a solid framework and open up scope for providing finance on a sustainable basis. For you as an investor, this means: Stability and attractive prospects.

European partners. A dependable network.

We work closely with European Export Credit Agencies (ECAs). Together with our partner banks, we participate in ECA-covered finance – or can assume this role in full. This is always based on state-backed cover – in Germany, for example, through Euler Hermes

Key documents. Valuable information.

Here you will find all the documents you need for making your investment decisions. They provide a comprehensive overview of the performance and orientation of AKA Bank.