Broad base. Strong partners.

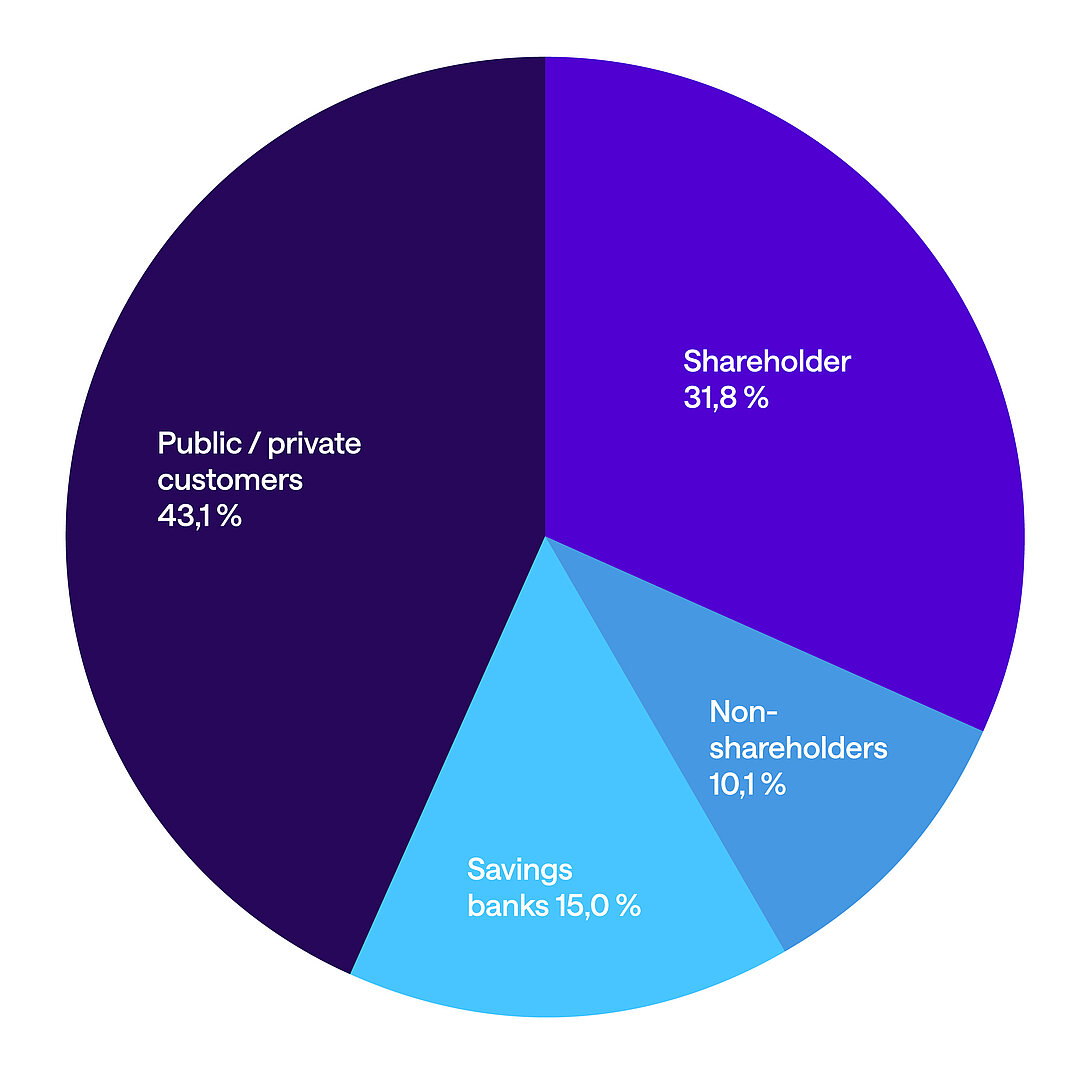

Our refinancing remains stable even when the markets are in turmoil. We are supported in this by our shareholders and private and public investors. This provides us – and you – with a broad base that ensures dependability and allows room for manoeuvre.

No trading books

Our treasury activities focus exclusively on the funding and risk management of our loan activities.

Solidity

We value liquidity, currency and interest-rate conformity of our activities.

Strategic partners

Our investors are our partners - we continue our long-term relationships.

Short-term funds. Long-term trust.

In 2024, we closed roughly EUR 850 million (incl. USD) worth of short-term deals with our refinancing partners. Typical loan periods are six to twelve months in euros and three to six months in US dollars. We are typically liquidity taker for the purpose of securing our refinancing base.

We are enjoying steady growth – on the money market as well as on the collateralised and uncollateralised capital markets. For us, investors represent more than just liquidity provider. They are our partners. Transparency and ongoing dialogue are important preconditions for exploring new opportunities with them. Wether longstanding or more recent partners – together we create a basis for solid growth, stability and a bright future.

ECA-covered loans

Our ECA-covered loans are commonly refinanced by our shareholders as well as public loans.

New pursuits

Since 2016 we open new refinancing alternatives together with international capital market partners with covered loans.

Structural shift

In 2024, already 19 % of our long-term covered fundings are established through new partnerships.

Well established in the capital markets

Continuous growth since our debut in 2016. Successfull collection of funds above 1.3bn. A strong signal of trust of our funding partners

Broad investor base

Our partnerships grow continuously and include insurance companies, pension funds, bank treasuries as well as regional and municipal bodies.

Important refinancing base

Our shareholdes remain a solid pillar in our refinancing structure. The funding of ECA covered transactions grow in importance for AKA.

Capital markets strategy

Together with our capital market partners, we determine which products allow us to align our strengths with their interests.

Successful milestones

The successful launch of our cooperation with Raisin in 2024 opens up new channel for term deposits at AKA and broadens our funding base.

Strong growth

Our capital market activities have developed dynamically. AKA established more than 50 partnerships worldwide.