70 years of experience. With an eye to the future.

Our story begins in 1952, when a group of state and private banks founded AKA to boost exports. Today we are a successful specialised financial institution aimed at shaping the trade finance of tomorrow.

1952

On 28 March 1952, a group of leading German banks spearheaded by Rheinisch-Westfälische Bank AG founded Ausfuhrkredit-Aktiengesellschaft (AKA) in Frankfurt am Main.

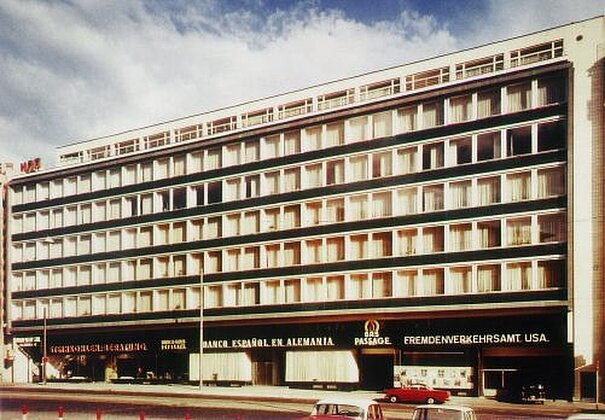

1961

Relocation to Große Gallusstraße 1-7 – which remains our home in the heart of Frankfurt to this day.

1970s

Introduction of forfaiting and buyer loans. The OECD Consensus of 1978 set new standards for fair export finance.

1976

The Hermes reform fundamentally modernized the German export credit guarantee system. It introduced clearer responsibilities, a more uniform review process, and stricter risk assessments in order to make government protection for export transactions more transparent and efficient. This led to lasting improvements in both the management of export promotion and risk protection for companies.

1980s onwards

Basic and master loan agreements with foreign banks gave exporters fast and reliable access to finance.

2000s

Expansion of the portfolio to include CIRR loans, multisourcing and debt rescheduling services. AKA Bank became a European trade finance institution.

2011

KfW IPEX-Bank joined our group of shareholders.

2017

Services opened up to banks outside the group of shareholders.

Today

17 shareholders, international networks, close alignment with the 17 UN Sustainable Development Goals and the European Green Deal.